Trevian implements Spektri Business Park’s new energy recycling system – the upgrades enable a significant reduction in CO2 levels

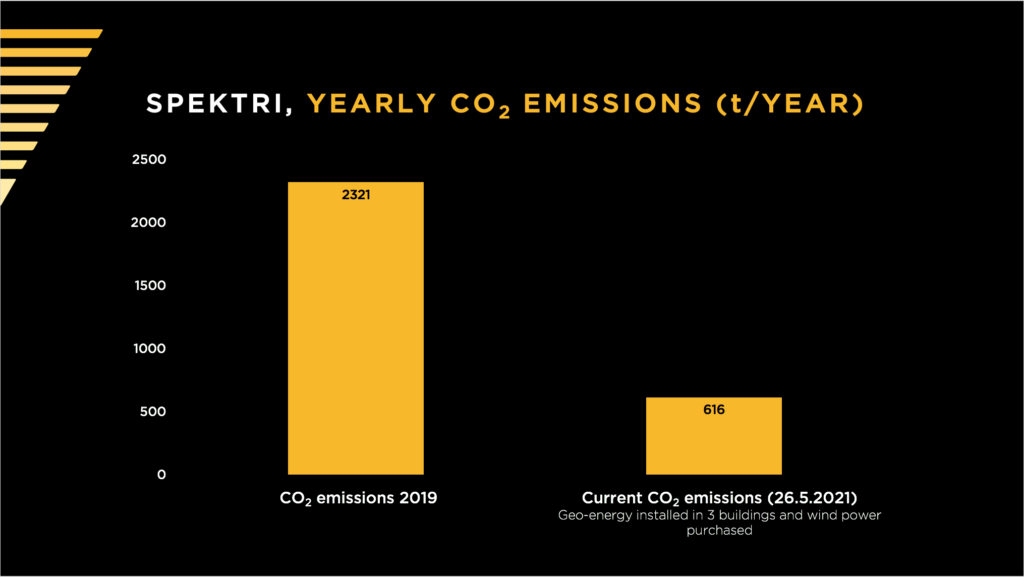

A massive and innovative project to implement an energy recycling system at the Spektri Business Park in Espoo, Finland has been completed. Spektri is managed by Trevian Asset Management. Trevian began the project to significantly reduce the carbon footprint of the Business Park in the summer of 2020 and completed it in the spring of 2021 in line with the initial schedule. Spektri has switched to the use of geo-energy for heating and cooling and simultaneously transitioned to electricity generated by wind power: The combined effect of these measures can be expected to reduce the business park’s carbon footprint by approximately 1,700 tonnes already during 2021.

Spektri is owned by the CCP 5 ‘long-life’ core-plus fund, advised by pan-European real estate investment manager Tristan Capital Partners.

The large-scale project implemented at Spektri combined a technical renovation of the buildings with extensive energy efficiency measures. The project has now been completed on the first three buildings – Pilotti, Duo, and Trio. The same measures will now be extended to the fourth building, Kvartti. The project for the final building, Kvintti, is in the planning stage.

The project design included a comprehensive energy recycling and heat pump system as an energy efficiency measure. For example, the waste heat from the data centre is redirected to the area’s geo-energy field or the property’s heating network. Geo-energy provides 80% of the heating and 90% of the cooling for the buildings. To maximize the effects, all the technical renovations have been designed to meet the objectives of the National Energy Efficiency Agreements. The indoor conditions at Spektri have been improved by utilizing automation. As an example, ventilation no longer runs on time programs but the basis of indoor air condition measurements.

The savings from energy efficiency measures will, in the long run, cover all property renovation costs. Spektri is currently undergoing BREEAM certification.

– The project successfully piloted both energy efficiency and a new type of procurement model. The schedule and core plan have been maintained despite the usual challenges associated with this type of renovation. Above all, this is thanks to an efficient design process. For Spektri, this is a major step towards a significant reduction in CO2 levels, says Vesa Klemettilä, Trevian’s technical director.

– For Tristan, maximizing energy efficiency is a crucial goal, including at sites in Finland. Spektri has been a high-priority project executed with technically innovative solutions. The pilot project, coordinated by Trevian, has been a good model from the owner’s perspective, demonstrating a combination of local cooperation as well as energy and cost-efficiency, says Victoria Yakubenko from Tristan Capital Partners.

– Improving energy efficiency is vital from both an environmental and cost perspective. However, it is a priority for Trevian to ensure tenants’ well-being in our premises. The energy project helps our customers achieve their own climate goals and improve the indoor working conditions. The project has been a massive one, and in addition to our partners, we would like to thank Spektri’s customers for the flexible cooperation to make it a reality, says Spektri’s asset manager Kaisa Granholm from Trevian.

In addition to Trevian Asset Management, the main partners in the project implementation have been Granlund Consulting Oy, Genpro Talotekniikka Oy, Koja Oy, and Otaverkko Oy.

About Tristan Capital Partners

Tristan Capital Partners is an employee-controlled investment management boutique specialising in real estate investment strategies across the UK and Continental Europe. Tristan’s pan-European real estate funds include core-plus and value-added/opportunistic strategies with total assets under management of over €11.5 billion. Tristan is the portfolio manager for core plus funds Curzon Capital Partners III, Curzon Capital Partners IV, Curzon Capital Partners 5 Long-Life and for the private equity funds European Property Investors, LP, European Property Investors Special Opportunities, LP, European Property Investors Special Opportunities 3, LP and European Property Investors Special Opportunities 4 LP and European Property Investors Special Opportunities 5 SCSp. Tristan is headquartered in London and has offices in Luxembourg, Milan, Paris, Stockholm, Frankfurt, Madrid and Warsaw.

Please visit www.tristancap.com.